replacing a central air conditioning unit cost

As a homeowner you may be asking, "Do I get a tax break for all the money I've spent fixing up my house?" The answer is, maybe yes, maybe no. But one thing is certain: You'll need to keep track of all those home improvement expenses. When you make a home improvement, such as installing central air conditioning, adding a sunroom or replacing the roof, you can't deduct the cost in the year you spend the money. But if you keep track of those expenses, they may help you reduce your taxes in the year you sell your house. Money you spend on your home breaks down into two categories, taxwise: the cost of improvements versus the cost of repairs. You add the cost of capital improvements to your tax basis in the house. Your tax basis is the amount you'll subtract from the sales price to determine the amount of your profit. A capital improvement is something that adds value to your home, prolongs its life or adapts it to new uses. There's no laundry list of what qualifies, but you can be sure you'll be able to add the cost of an addition to the house, a swimming pool, a new roof or a new central air-conditioning system.

It's not restricted to big-ticket items, though. Adding an extra water heater counts, as does adding storm windows, an intercom, or a home security system. (Certain energy-saving home improvements can also yield tax credits at the time you make them.) The cost of repairs, on the other hand, is not added to your basis. Fixing a gutter, painting a room or replacing a window pane are examples of repairs rather than improvements. Tracking less critical than in past In the past, it was critical for homeowners to save receipts for anything that could qualify as an improvement. Every dime added to basis was a dime less that the IRS could tax when the house was sold. But now that home-sale profits are tax-free for most owners, there's no guarantee that carefully tracking your basis will pay off. Save when you sell Under current law, the first $250,000 of profit on the sale of your principal residence is tax-free ($500,000 for married couples who file joint returns) if you have owned and lived in the home for at least two of the five years leading up to the sale.

When this rule was passed into law, a lot of advisors thought it meant homeowners no longer had to track their basis. After all, how likely was it that someone would score a quarter of a million dollar profit (or a cool half a million) on their home? But even that large an exclusion may not be enough to shelter the profit in a home that you've owned for many years. So it still pays to keep good records. To determine the size of your profit when you sell, you take everything you paid for the house, the original purchase price, fees and so on, and add to that the cost of all the improvements you have made over the years to get a grand total, which is known as the "adjusted basis." (If you sold a home prior to August 5, 1997 and took advantage of the old rule that let home seller put off the tax on their profit by "rolling" the profit over into a new home, your adjusted basis is reduced by the amount of any rolled-over profit.) Compare the adjusted basis with the sales price you get for the house.

If you've made a profit, that gain may be taxable (generally only if the profit is more than $250,000 for an individual or $500,000 for a married couple filing jointly). Unfortunately, losses on sales of personal residences are not deductible.

car air conditioning repairs browns plains You can see it makes sense to keep track of whatever you spend to fix up, expand or repair your house, so you can reduce or avoid taxes when you sell.

cost of new hvac ductwork Make a special folder to save all your receipts and records for any improvements you make to your home.

how much is 2 ton ac unit If you've lived in your house for many years, and area housing prices have been gradually going up over all those years, a portion of your gain on sale could be taxable.

If so, you can reduce the taxable gain by including the improvements in the cost basis of the house. If you operate a business from your home or rent a portion of your home to someone, you may be able to write off part of your home’s adjusted basis through depreciation. If you do so, when you sell the house you can’t exclude the amount of depreciation you took under the $250,000/$500,000 gain exclusion break. Also, the cost of repairs to that portion of your home may be currently deductible.Like so many powerful innovations, central air conditioning is easy to take for granted. The cool, dry air that whispers unceasingly from wall and ceiling registers can lull us into a false sense of security. Then an electric bill arrives, or the system starts to falter. Suddenly we realize that basic maintenance was called for--just cleaning the air filter would have cut cooling costs 5 to 15 percent. Or perhaps it's time to replace an old and inefficient central air conditioner. There are a number of options to consider, including high-efficiency systems that can reduce electrical cooling costs 20 to 30 percent.

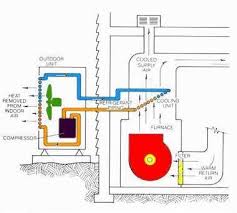

Here's a crash course in the mechanical system that helps you keep your cool when temperatures start to climb. Conventional central air systems graft into a house that has ducts for forced-air heating. The hot and noisy portion of the cooling system, the compressor-condenser, is located outside. The cool and quiet component, the evaporator coil, is located inside, above the furnace blower. Cool, dry air is distributed; warm, humid air returns to be cooled and dried.%" align="center" style="padding:2px;border-right:1px solid #ccc;">%" align="center" style="padding:2px;border-right:1px solid #ccc;">%" align="left" style="padding:2px;border-right:1px solid #ccc;">Houses heated with boilers lack ducts to distribute cooled air. They can be centrally cooled with mini-duct systems in which an evaporator coil, fan and trunk duct are located in the attic. Cooled, high-velocity air is piped from the trunk duct through flexible, insulated plastic ducts.>A ductless split system is the answer for many homes that are not centrally cooled or that need more cooling after an addition is built.

The compressor-condenser serves one or more evaporator coil fan units installed on the inside walls of the house.The Refrigeration CycleMechanical, chemical and thermal energy act together in your central air-conditioning system to cool and dehumidify indoor air. Warm liquid refrigerant is driven under high pressure toward the evaporator coil.2. Near the evaporator, the liquid flows through a metering device that functions like a garden-hose nozzle. It converts the warm, high-pressure liquid into warm, low-pressure droplets.3. As the droplets enter the evaporator coil they begin to cool, and the droplets are transformed into cold vapor.4. A fan blows warm, humid indoor air over the cold coil. Moisture in the air condenses and drips off the coil into a pan to be drained or pumped away. The gas in the coil warms as it removes heat from the indoor air.5. When the compressor turns on, it draws the warm gas toward its suction port. The gas enters as a warm vapor and leaves hot and at high pressure.

Now it enters the condenser, and as it makes its way through the labyrinth of tubing, it gives up its heat to air moved by the condenser fan. The gas condenses into a warm liquid ready to repeat the cycle. The Lennox SunSource is a heat pump with a solar assist. Its condenser fan motor draws power from a 190-watt photovoltaic panel, a $3000 add-on. The high-efficiency heat pump itself costs $4000 to $7500, depending on the installation. The equipment runs the refrigeration cycle in reverse for winter heating, so it achieves energy gains year-round, not just in the summer cooling cycle, accelerating the energy payback of the photovoltaics. In most cases the solar panel is installed in a sunny location, either on the roof or the side of the house. Wiring then runs from the panel to the fan motor.Equipment CheckThe best way to ensure a steady flow of cool, dry air this summer is to do a little basic maintenance this spring."The key to maintenance is air flow," according to PM contributor Pat Porzio, a heating-cooling contractor and mechanical engineer.