air handling units market

Vertical Air Handling Unit (FXTQ_PAVJU) Concealed, Powerful, Compact, Comfortable The vertical air handling unit is designed for use with all Daikin VRV systems, allowing more flexibility and combination possibilities. With a capacity range from 12 to 54 MBH and both upflow and horizontal right installation possibilities, the unit is ideal for both residential and light commercial applications. Reduced installation time with integrated Electronic Expansion Valve and Printed Circuit Boards Improved application flexibility with the ability to mix and match with other Daikin indoor units on the same system Wider application range with dual voltage 208-230V/1ph/60Hz power supply Reduced piping cost with smaller piping diameters Only up flow and horizontal right installation is permitted Improved user comfort with 2 selectable fan speeds (H and L) New fan "Auto" logic allowing the unit to be commissioned where the fan operation will cycle on and off with the load

The ECM fan motor as standard contributes to the increase in energy efficiency, reduction in sound and increased ESP (up to 0.5" W.G.) Ideal replacement for traditional fan coils or vertical stack units New construction or replacement click on image to expand The FXTQ_PAVJU represents an improvement in electric heater options and control logic versus previous units: Wide line up of electric heat (field installed) options from 3kW to 20kW

auto ac repair tempe az Integrated KRP1 function to minimize cost

top residential ac unit Electric heater operation in combination with heat pump operation (boost) is now possible

central air conditioner parts listThe UK air-conditioning market is changing. No longer is it a straight fight between fan-coils and chilled beams.

Variable flow refrigerant systems are developing into various different guises, with roof-top units showing strong potential for growth. David Garwood presents the headline statistics. Everybody, it seems, wants air conditioning. In 2006, BSRIA estimates that the total value of the UK air conditioning market was a little over £692 million. The market is thought to have risen further in 2007. But where are the trends heading? The market in 2007 There was strong growth in demand during 2007 for new build and refurbishment of offices. Property developers took advantage of lower borrowing costs. Many manufacturers reported the growth in the market for central plant and packaged products to be positive as their clients were accelerating construction and refurbishment programmes. However, with the rises in interest rates and the recent turmoil in the financial markets this is expected to change. It is now more difficult to fund the projects through acquisition of loans.

BSRIA expects a decline in new orders into 2008. There may be a swing towards refurbishment as opposed to new build, as budgets will be tighter. The roof-top market experienced an increase in volume and value in 2006. The market has recovered to levels last seen in 2004. The increase is largely due to investment from the retail sector such as cinemas, and fast-food restaurants, which is bucking the trend in consumer spending. In 2006, roof-top products became available above 200 kW. Together with other recent technology developments, this has allowed rooftop systems to start to penetrate the traditional chiller/air handling unit market. The rooftop product can perform all the requirements of these conventional systems in one box, so it will benefit from applications of low capacity and were plant space is limited. The total market size for air handling units recovered in 2006 to the level last seen in 2004. The market grew by 13 percent in volume and 14 percent in value in 2006 over 2005.

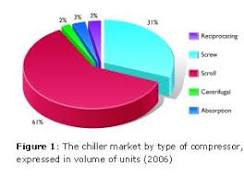

Modest growth is expected in 2007 as a number of manufacturers reported significant sales on the back of further growth in the UK construction industry, particularly in the office sector and the chiller market as a whole. Manufacturers and suppliers are currently experiencing high demand for close-control equipment, enabling companies to place a price premium on their products. The growth is being driven by a number of factors including: Growth is expected to decline after 2008, as there are a limited number of merchant banks and other end-users requiring data centres to be built. This will also affect increases in the average price in 2008 and beyond, when pressure on price is expected to be down. The market will continue to experience shifts in compressor type, refrigerant and size. There has also been growth in recent technologies such as the Turbocor and inverter screw-compressors. Scroll compressors are continuing to erode the market share of screw and reciprocating chillers through further developments of larger capacity units with R410A refrigerant.

But as with screw compressors, scroll compressors are facing increasing competition from VRF systems, especially in refurbishment projects. Reciprocating chillers have lost significant market share. Many manufacturers are no longer including them within their portfolio and they now account for less than three percent of the market. For more information contact Worldwide Market Intelligence at BSRIA: Tel: +44 (0) 1344 465600weatherproof construction variant for outdoor installationProducts » Indoor Air Handlers & Fan Coils » Indoor Air Handlers and Fan Coils The Indoor Air Handling (IAH) units include belt driven fans designed for air conditioning and/or heating buildings or specified spaces. They are developed to meet commercial applications such as schools, medical facilities, and office buildings. The Low-Profile Fan Coil (LFC) is a forward curved low cost, dual wall constructed blower coil unit. Performance capabilities range from 300 to 4,700 cfm and up to 3.5 in. wg.

The LFC is available in eight compact sizes. Unique features are listed below. * Ultra-low profile - as low as 11 inches * Accessibility - dual side access * One inch double wall construction - provides superior IAQ * Internal neoprene isolation - dampens internal vibration * Stainless steel drain pan - insulated double wall * Internal flex connection Unique Accessories for Model LFC: * Internal spring isolation - lowest profile units on the market * Pre-filters - 2-inch 30% (MERV 8) or 4 inch 65% (MERV 11) efficiencies (vertical only) (1/4 turn fasteners standard for quick access) * Coils - hot water, steam, chilled water, and direct expansion (total of 8 rows) * NEMA 1 disconnect switch The Modular Small Cabinet Fan Forward Curved (MSCF-FC) and Modular Small Cabinet Fan Backward Inclined (MSCF-BI) are low-profile, dual wall, modular constructed, essentially a custom mini air handler. Performance capabilities range from 300 to 4,700 cfm and up to 4 in. wg.

The MSCF units are available in eight compact sizes. * Modular design - easy to install * Accessibility - dual side access to each module * Stainless steel drain pan with insulated double wall * Pre and/or post filters - 2-inch 30% (MERV 8) or 4-inch 65% (MERV 11) efficiencies, or 4-inch 95% (MERV 15) efficiencies (vertical and slopped) * Coils - hot water, steam, electric, chilled water, and direct expansion * Re-heating coils - hot water and steam * Pre and/or post plenums - 12 or 24 inch access for mounting controls * Mixing Box - with or without filters, dampers, and actuators The Vertical Fan Coil (VFC) is a vertical forward curved, dual wall constructed unit. Performance capabilities range from 300 to 3,500 cfm and up to 3.5 in. wg. This unit is available in seven sizes. Unique Accessories for Model VFC: * Internal spring isolation * Pre-filters - 2-inch 30% (MERV 8) or 4 inch 60% (MERV 11) efficiencies (vertical only) (1/4 turn fasteners standard for quick access)